Houses can be a lot like people. We separate ourselves into ‘generations’ because we feel that we have common traits that define us in many ways, based on how old (or young) we are. Baby Boomers, Millennials, Generations X and Y, and now Gen Z – or Centennials (I love that one!): Each group has tendencies, and common character strengths and weaknesses.

When we talk about houses having ‘character,’ we are referring to unique features that add beauty and class to the architecture. Some would say that every house has ‘personality,’ for better or for worse, to go with that character.

Building methods change and improve, for the most part, as they years go by, but there are some trends in the industry that turn out to be big mistakes. Once they are discovered, necessary renovations can be expensive. Whether you are working to maintain a home you already own or are looking to buy a place, it’s good to be aware of potential issues before they cause maximum damage.

Here is a timeline of a few of the common construction weaknesses and defects in houses of ‘a certain age’ that could cause you financial pain:

Houses built between 1995-2007:

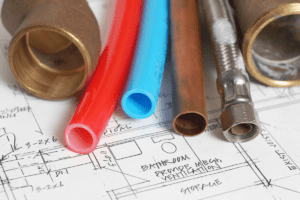

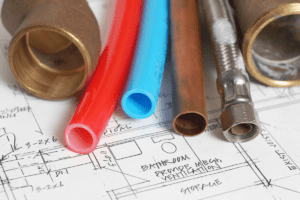

If a house or apartment building was built during these years, it is important to identify what type of plumbing materials were used. Kitec plumbing was widely used during that period, but has since been discontinued because of its tendency to leak or even burst, causing flooding. You may be able to recognize it by its blue and orange flexible piping, and you may find a yellow sticker on the inside of the door to your electrical panel with a warning something like: “Caution: This building has non-metallic interior water piping.”

Despite the fact that plumbers really liked the ease of installation, Kitec turned out to have a very short life span and has caused some extreme property damage. The only solution is to replace all of it with more traditional copper, or pex, which can be a messy, expensive job. A massive class action lawsuit was open until January 9, 2020 for anyone who was affected by the problem.

..

Houses built between 1965-1973:

Due to the rising price of copper during the mid-1960’s to the mid-1970’s, builders used aluminium as an alternative to copper electrical wiring. Despite the popular misconception that aluminium wiring has been banned or recalled, the material itself is actually still legal, even for use in new construction. Don’t take our word for it! Check out Ontario’s Electrical Safety Authority.

If you’re not sure whether you have aluminum wiring, there are some ways to identify it here.

Aluminium is not at all forgiving of poor installation practices, and it is a definite fire hazard if not handled by a licensed electrical contractor. There is no need to panic if your current home has aluminium, but you may want to have a thorough inspection done if you don’t know the full history of the house or any renovations that might have been done over the years.

Even if you know your wiring is safe and properly installed, you may find that the biggest problem you have comes when you try to sell. Buyers may be afraid due to misinformation or pre-conceived ideas. If your home has aluminium wiring, prepare to adjust your expectations accordingly upon selling the property.

Insurers who offer coverage will charge more for a policy on a house with this type of wiring.

During this period, builders also installed fewer electrical outlets in each room than they do today, and fewer circuits overall. You might find that our modern way of life, with all the gadgets and appliances being used daily, requires a panel upgrade. Always hire a licensed electrical contractor to do any upgrades or make any changes to your home’s wiring. It is money well spent on the safety of your home and family!

Houses built up to 1990:

Vermiculite insulation that was used up to the late 1980’s *may* contain asbestos, which is now a known carcinogen. Most vermiculite does not have asbestos, but there is no way to know for sure without an environmental test. If left undisturbed, there is reportedly very little to no risk associated with it. In a friable state (prone to crumbling into small particles), or if it becomes airborne (most often during a renovation when things are being sawed, sanded, or otherwise shaken up), inhalation of the small particles can cause lung cancer or mesothelioma.

Besides insulation, asbestos was used until about 1980 in old floor tiles, ceiling tiles, some roofing materials, siding, insulation (around boilers, ducts, pipes, sheeting, fireplaces), pipe cement, and joint compound used on seams between pieces of drywall.

Clearly, it is worth the peace of mind to have an asbestos abatement professional test any vermiculite or other questionable materials you may find, as well as to consider replacing contaminated insulation, etc., with something safer.

Homes built between 1975-1980:

While we are on the topic of insulation, UFFI (Urea formaldehyde foam insulation) is something you should be aware of. UFFI is an expanding foam that was mixed onsite, and sprayed or pumped into under-insulated buildings through small drilled holes.

After its peak use from 1975-1978, the product was banned in Canada in 1980 because it contains formaldehyde. There was concern that off-gassing of this substance was a serious health hazard. Many people are of the opinion that UFFI is unfairly stigmatized, and that it is not the dangerous carcinogen it was once thought to be. In fact, the US Court of Appeals overturned the American ban on UFFI in 1983, and the material is still legally used in Europe. For more information (and pictures) read up on it here.

Nevertheless, here in Ontario, it is important that you be aware of the possible presence of this type of insulation. Our standard real estate purchase agreements include a warranty to the Buyers that there is not, nor has there ever been UFFI installed. Not acknowledging or disclosing the presence of existing UFFI could lead to a costly lawsuit.

Homes built up to 1980:

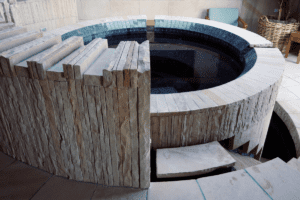

Any house with plumbing installed before 1980 could have clay sewer pipes to carry waste away from the house. The typical life span of this type of pipe is about 50 years, as compared to PVC, which, reportedly, can last up to 100 years. The most common problem with clay pipe is its susceptibility to invasion by tree roots. As the roots seek the moisture contained in the pipes, they can cause real damage. If you smell a foul odour, have sewer backups, or hear weird gurgling sounds in the kitchen or bathroom pipes, it would be wise to have a plumber send a camera down through the drainage system to inspect the state of the clay pipe. Different solutions may be available, depending on the amount of damage that has occurred. If the pipe is mostly intact, you may be able to have a cured-in-place liner installed without digging up your property. Where the deterioration is too far gone, it may be necessary to dig up the old and install brand new pipes. If you are a resident of Hamilton, part of the repair that includes the plumbing leading to the municipal sewer may be reimbursed by the City. While you are doing this type of work, consider installing a backwater valve, too – since the cost of it is also covered by the Municipality. Two options are available to avoid a costly out-of-pocket repair should you need it.

1) Check your home insurance policy – some policies cover service lines. If you’re covered, great!

2) The City of Hamilton has a program in place where you can pay $64 per year for coverage. In our opinion this is a must-have. You can read more about it here.

..

Homes built between 1900-1950:

Unrenovated homes built in this era very likely still have knob and tube wiring. Although the Electrical Safety Authority still recognizes it as a usable electrical system if properly maintained, many insurance companies will refuse to cover a property that has this type of wiring. Without getting overly technical about it, this old style electrical wiring is not grounded, thus increasing the risk of fire. It is also insulated with rubber materials that may degrade over time, exposing the wires.

If you are considering buying an older home or suspect your current home may not have been fully updated, make sure to inspect it carefully for old wiring. This is especially tricky if the basement and attic are completely finished. Some active knob and tube could be hidden behind finished spaces, even if the majority of the electrical system has been replaced. If you see 2-prong outlets, or tandem/parallel outlets, have a licensed contractor take a look and advise you as to how safe the wiring is.

Homes built up to mid-1950’s:

Single family homes and small multi-unit buildings of this age may still have lead water-service pipes. By now, it is common knowledge that lead is not safe in drinking water, and that this type of plumbing should absolutely be replaced. Less commonly known is that there may be lead in fixtures, such as faucets and valves, as well as soldering wire, used until approximately 1990.

Even if your interior water supply lines are copper, a home inspector or plumbing contractor may be able to identify incoming lead supply pipe from the municipal lines. If the connections are not visible, you may get a clue from your water pressure. Low pressure may indicate old water supply lines. A request for an upgrade to improve water pressure sometimes triggers the investigation into whether there is lead in the supply to your home.

If you are at all concerned about this particular health hazard, contact your municipal offices to see what programs, grants, or projects they are currently working on. (For the City of Hamilton click here.)

Typically, homeowners are responsible for any repairs or upgrades to the pipes on their own property, while the municipality covers the cost of replacement on the public supply side. When you inform the City that you will be replacing any old lead pipe on your private property, they usually follow up with replacement on their side of the system.

While waiting for help to remove any existing lead pipe, a filtration system may help improve water quality in your home. Research your options thoroughly to learn how to ensure that you and your family are drinking safe water.

Houses from this era were not well insulated. Building standards are continually being improved, and insulation has gradually made homes more comfortable during seasonal extremes, all the way from the basement to the attic. Proper insulation also makes a more energy efficient home. For finished spaces, the easiest way to add insulation is usually to have it blown in. Check out some expert advice about staying warm in an old house here.

Maintaining your home is part of protecting your largest investment. As new technology and building methods continue to be discovered, we will surely continue to see improvements in safety and quality standards. Homeowners who continue to upgrade and stay current will not only enjoy the comfort of their homes, but they can also expect to see the returns on their investment with increased value if and when they decide to sell.