When you need a reliable prediction of what to expect in the upcoming year, it makes sense to pay attention to those with a good track record of accurate forecasts. 2020 has challenged even the most skilled prognosticators. Who had it right? And what does a clear view of the 2021 housing market look like?

How Do “They” Make Their Predictions

Trend watchers and industry insiders use the data they have to make forecasts. They also have to factor in intangible factors, like consumer confidence. One way to measure this is by frequent polling. For example, the BNCCI [Bloomberg Nanos Canadian Confidence Index] does weekly surveys of Canadians to assess the ‘economic mood’ of real people.

At the beginning of November, Canadians were slightly pessimistic on the economy in general, while their confidence in the strength of the real estate market stood strong. Market activity in the Hamilton-Burlington Board supported this assessment, with average sale prices and sales volume in the area noticeably up over November 2019. This, despite projections of a sharp decline by some analysts earlier in the year.

We can crunch all the numbers we want, but it is real live people who buy and sell real estate. That’s what makes this indicator so powerful.

Of course, the emotional mood has to work alongside the economic and practical data to form an accurate forecast of what is to come. So what other information helps us paint a real picture of what to expect?

Though some statistics can apply across the country, the more localized the data we use, the more relevant it will be to our current market. We will focus on the Hamilton-Burlington Board area, which includes information about Burlington, Niagara, Haldimand County, and Brantford.

Supply and Demand: The Inventory Story

As with every service and commodity, housing prices respond to the balance between supply and demand. In other words, if there are more buyers than sellers, prices rise.

This is what we are seeing on a daily basis. It is a rare listing that does not attract multiple offers. Buyers compete for available properties, and many sell for over asking price throughout our region.

One metric that we use to determine the slant of the market is months of inventory. This is the number of months it would take for all currently listed properties to sell if no new listings were to come onto the market.

When we divide the total number of homes for sale by the total number of homes sold in a month, we will get one of three results:

- A seller’s market is indicated when we see four months, or less, worth of inventory.

- A balanced market is when we see between four and six months of inventory.

- A buyer’s market is when we see six months of inventory or more.

As of December 9, 2020, there are 2068 active residential MLS listings, including both freehold and condo units of all sizes in the following areas:

- Brantford

- Hamilton

- Haldimand

- Niagara

- Burlington

In the preceding 30 days, the same areas saw firm sales of 2274 units. These numbers indicate that current inventory stands at 0.91 months. If no new listings came onto the market, all units for sale today would be sold in less than one month. That is a very strong seller’s market in these regions, with demand far outstripping supply.

Some of the demand is coming from move-over buyers. The pandemic has motivated a segment of Toronto buyers to move to outlying areas. Now that they can work from home, commuting distance is less of an issue than ever before.

The decline in the Toronto condo market is part of the demand story. We are seeing buyers who want more space moving farther out from the city’s centre, and taking their buying power with them.

Hamilton, Burlington, and parts of Niagara also offer living that compares well to many Toronto neighbourhoods, albeit on a smaller, less expensive scale. Some city-dwelling buyers dream of a tranquil country property. They now find that they can afford to have everything they want while working from comfortable home offices outside the GTA. Popular areas for this type of buyer include Binbrook, West Lincoln, Port Colborne, Lincoln, or Haldimand County. The appeal to our region is easy to understand.

The shortage on the supply side is partly due to home owners who are putting their plans to sell on hold.

Several things factor into the decision to postpone selling. Some of these are: health concerns, fear of having strangers in the house, job and economic uncertainty, and conflicting predictions for the coming year.

The option to defer mortgage payments in the spring of 2020 allowed many home owners to keep their homes through a temporary period of unemployment. (September 30 was the last day to apply for deferrals, and anyone who remained unemployed after that time may soon be forced into a position where they must sell.)

Home owners also realize that, though it will likely be a breeze to sell at a good price, they will face a different scene as buyers. Bidding wars, rising prices, and a shortage of good options discourage some from listing, keeping supply tight.

Analysts and Statistics…

PwC (PricewaterhouseCoopers), an international firm that provides data/analytics and consulting services, acknowledges conflicting trends that are emerging in its 2021 Outlook For Canada’s Housing Market. On the one hand, there is the move away from urbanization. The pandemic has created a shift in our collective mind-set, fueling the desire for more independent space and the ability to isolate in comfort. On the other, there is the demand for urban-style options where work/live/play elements are the priority. Time will tell whether the migration away from large cities will be a permanent change.

Though unemployment is still higher than it was pre-pandemic, a large number of Canadians have been able to get back to work – bringing the unemployment rate down from a high of 13.7% in May to 8.5% in November. Signs point to a modest recovery, which will likely be accelerated if and when a vaccine becomes widely available.

We can’t neglect to mention historically low mortgage rates, as low as 0.99% for first-time buyers. For as long as borrowing is cheap, demand is likely to remain high.

What New Construction Tells Us

New housing starts are a carefully monitored indicator of demand as well. CMHC tracks activity in the construction of new residential units across the country. You can find Ontario statistics here.

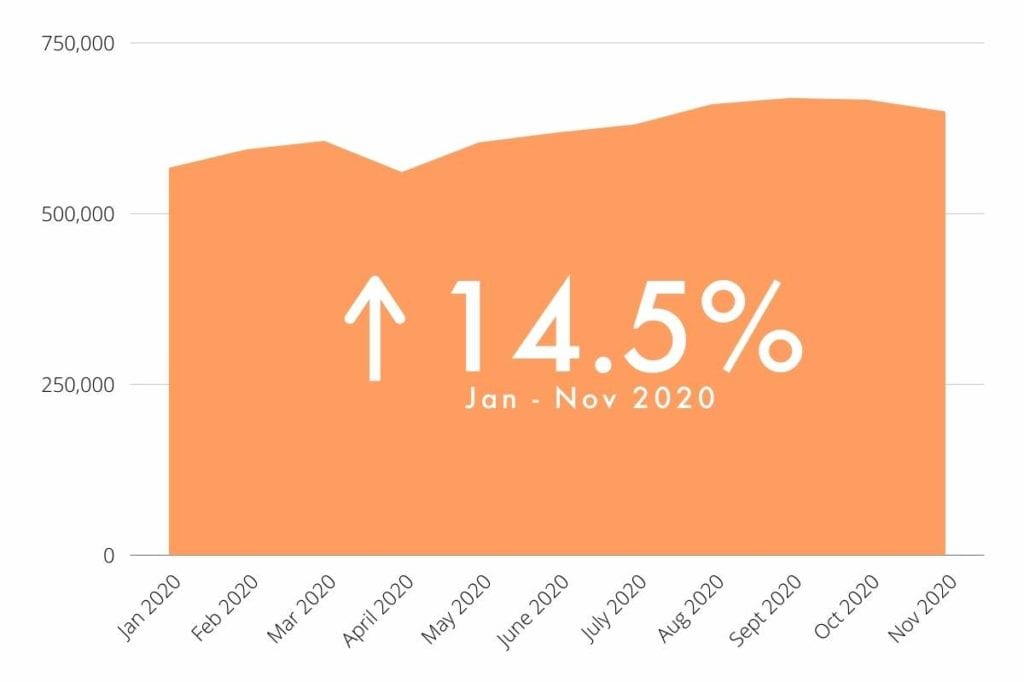

This sector of the market is also growing at a healthy pace, slightly up from last year’s numbers. Housing “starts” are counted when footings or foundations are installed for a new residential unit. This could be any type of property, from detached to multi-family dwellings, such as apartments.

The latest available data for Ontario measures the year-to-date numbers as at the end of October. The YTD starts this year are 65,577, up from 57,292 at the same time in 2019.

Completions of residential units are also up – 55,426 as of the end of October, 2020, compared with 45,971 in 2019.

We can attest to the fact that demand for pre-construction and new builds is very high. Competition can be as fierce here as it is for resale/MLS listed homes. Sales offices are struggling to keep up with the number of appointment requests these days.

Our Thoughts

We work with buyers and sellers every day, and we see the reality of the strong seller’s market that the numbers verify. It may make no sense, with our economy suffering from the effects of a global pandemic, and with many small businesses under intense pressure. At the beginning of 2020, we certainly would not have been too confident that the real estate market could thrive as it has.

Now that we have come through the past nine months, we have the benefit of hindsight. We see the human indicators that tell us that real people are very invested in their home as a safe haven. Canadians have always valued real estate as an investment. But this year has reinforced our desire to have a comfortable, multi-purpose, safe, place to call home.

One sad fact that is clearer than ever is that lower-income earners are the segment of the population that is most affected by the economic downturn. Many of those whose jobs are affected by the health crisis are renters. [Rents are down in 2020.]

Professionals and other white collar workers who can work from home, as well as skilled tradespeople and other essential workers are still earning steady income. These make up the majority of home-buyers, and they are driving the market.

The Bank of Canada released a statement on December 9 to confirm that it will maintain the interest rate at its current low to encourage economic recovery. This means mortgage rates are likely to stay very affordable.

Seller’s Market Here to Stay for a While

Based on all the factors we can measure, it looks very much like our real estate market will continue to grow. When some experts were predicting gloom in 2020, Remax was much more optimistic, based on detailed knowledge of market activity. The 2021 Market Outlook is similarly positive.

For the record: We would love to see a little balance return to the market. We look forward to seeing our buyer clients have a little more leverage and negotiating power. However, for the foreseeable future, it looks like sellers will continue to reign supreme.

Looking to Buy or Sell in 2021?

Leave your details here and we'll reach out ????