Condos appeal to people for different reasons. Some are buying their first home and want something that fits the budget. Some are downsizing and ready to offload maintenance. Others simply like the locations, the amenities, or the simplicity.

Sometimes a detached or freehold home would be nice, but it doesn’t make sense financially. Other times, a condo is the right call for other reasons.

What matters is understanding how condo ownership actually works day to day, and where it tends to be a great fit or a source of friction.

The UPSIDE*:

Convenient locations

Most condo buildings end up in areas people already use every day. Walkable streets, transit nearby, restaurants, groceries, and errands that don’t require a car. For many buyers, that convenience shows up quickly in daily life and becomes one of the biggest benefits.

Built-in community**

Living in a shared building means you tend to recognize people. You see the same faces in the elevator, the gym, or the parking garage. Some owners enjoy that low-key sense of familiarity and the added comfort of having people nearby.

..

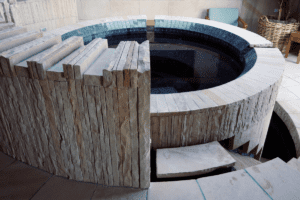

On site amenities

Amenities are often what tip people toward condo living. Depending on the building, that might mean a gym, pool, party room, rooftop space, barbecues, or guest suites for visitors. Concierge services and security can also be part of the appeal. You get access without having to manage or maintain any of it yourself.

..

Lower initial purchase price

For many first-time buyers, condos are the most accessible entry point. A lower purchase price can make ownership possible sooner and allow buyers to start building equity without waiting years to save a larger down payment. At the other end of the spectrum, there are also high-end condo buildings that attract buyers looking for something very specific.

Less maintenance

One of the clearest advantages is how little hands-on work is involved. No mowing, no shovelling, no exterior upkeep to plan around your weekends. For people who want to own without constantly managing a property, this can be a real relief.

Well suited to travel

If you travel often or spend time away for work or extended trips, condos make that easier. You can lock the door and leave without worrying about snow buildup, exterior maintenance, or an empty house drawing attention. Buildings stay active, and issues are more likely to be noticed quickly. (See Built-In Community above!)

..

Built-in planning for long term repairs

All homes need maintenance over time, and those costs add up. Condo fees include contributions to a reserve fund that is meant to cover future repairs like roofs, windows, elevators, garages, and common areas. In a well-run building, this spreads costs over time and reduces the likelihood of sudden, large expenses for individual owners.

*Many of these items refer to apartment condos. You may also choose to live in a townhouse condominium, which usually means lower fees with fewer amenities, and less central location.

** A plus for some people, less appealing for others.

The DOWNSIDE:

Condo fees affect what you can afford

When lenders assess a mortgage application, condo fees count as a monthly obligation. Higher fees can reduce the amount you qualify for, even if the purchase price looks reasonable.

Close quarters living**

Shared walls, shared spaces, and shared schedules are part of condo life. If privacy and independence matter a lot to you, this can start to feel restrictive, especially in buildings with higher density or poor sound insulation.

..

Rules and restrictions

Condo living comes with by-laws. These can regulate pets, rentals, renovations, window coverings, and even paint colours. The rules are enforceable, and boards can issue fines or take legal action if an owner does not comply. This is one of the biggest lifestyle differences compared to freehold ownership. To some, it feels like creating safety. Others find it stifling and resent the limits on their personal freedoms.

..

Parking and storage limitations

Urban condo buildings often have limited parking. Most units come with one space, and additional spots are rare. Multi-car households can run into issues quickly.

I once looked at a condo for a client with three vehicles. The building allowed a maximum of two parking spaces per unit, with no option to rent or purchase a third. When I asked the property manager if there were any workarounds, his response was simple: “If you need three spaces and you buy in here, you’re setting yourself up for nothing but grief.”

Storage can present similar constraints. Many buildings offer a single locker, which may not suit people with larger storage needs.

..

Limited control over finances

Condo boards and property managers oversee budgets, maintenance, and reserve funds. When management is strong, owners benefit. When it isn’t, issues tend to show up in rising fees, deferred repairs, or concerns during resale when buyers review the building’s financials.

Special assessments may hurt resale value

If major repairs arise and the reserve fund is insufficient, owners may face a special assessment. This can mean a lump-sum payment or a temporary increase in fees. These assessments appear in the status certificate and are visible to buyers. In many cases, buyers will expect the seller to cover the cost as part of the transaction.

..

This isn’t a complete list, and it isn’t meant to push anyone in one direction. How you live, how much control you want, and how you prefer to budget all factor into a decision.

If you’re considering condo ownership in the Greater Hamilton Area, it’s worth taking the time to understand how different buildings operate before committing.