The theme of 2020 has been – uncertainty.

We are all feeling it in one way or another. There is anxiety over health concerns, job insecurity, and major life decisions.

For many home owners, there is a sense that the economy could dip, taking much of their real estate equity down with it. And that’s a scary thought, especially for people who are approaching retirement age.

Is the Market Going to Crash?

Ah, the million dollar question…and in the Toronto market…maybe more than a million!

The truth is, even the most skilled expert can only guess what is going to happen to the real estate market.

Back in 2017, some well-respected analysts boldly predicted that the market would fall 28% by 2020. In hindsight, that was a needlessly pessimistic forecast.

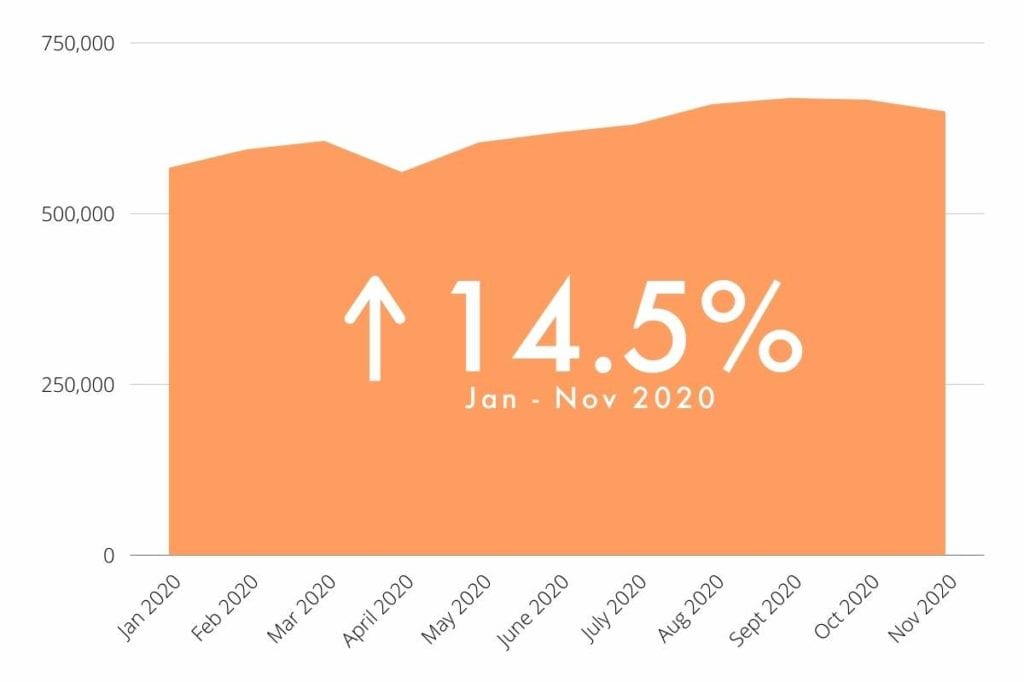

Here we are in 2020. At the height of COVID uncertainty, Evan Siddall, the CEO of CMHC, lambasted realtors and others within our industry in May. He asserted that anyone who claimed house prices would rise was, essentially, a bad actor looking to do you harm. This, while Remax remained confident in the strength and growth of the Canadian market.

Either forecast could have been accurate. So many factors combine to motivate buyers and sellers that it is impossible to predict exactly how and when the tides will turn. At the time of this writing, it is the beginning of December.

As this crazy year winds down, any home buyer will tell you that competition has been fierce, inventory has been tight, and home values continue to rise. Mr. Siddall’s skepticism (and cynicism) were somewhat premature, apparently.

Having said all that, we know that real estate (like other markets) moves in cycles, and that corrections do occur. We can only follow trends and look for signs of change in the short term. For now, buyers still outnumber sellers, and for as long as demand outpaces supply, the upward trend continues. When we see that shift toward balance, with more listings available and fewer buyers competing, we will know that things are starting to cool down.

How Will I Know When to Cash Out?

We are hearing from more and more people that they are considering selling their homes and renting a place in order to protect the equity they have built. They fear that we are in the peak of the market and they don’t want to lose any money. It may make sense for you to cash out now, but there are a few questions you need to ask yourself before making your decision.

-

Where will you go?

Are you thinking of exiting the market entirely to rent a place? Or are you looking to downsize into a smaller home? Do you plan to stay in your own neighbourhood? Or are you ready to move to a less expensive area?

Right now, in Hamilton and the surrounding area, downsizing can be a challenge. Smaller, lower-priced homes are in high demand. Investors compete with first-time buyers and downsizers for the same pool of properties, and that drives prices up. Be sure to explore your options before selling your larger home. Make sure there is enough margin to make it worth the move.

If you are looking to move out of the city to a place where the cost of living is much lower, that will likely make downsizing a more profitable decision. Be sure to research house prices with the help of a local expert in your desired area. Once you know how much house you can get for your money, you will be in a better position to crunch numbers and decide if relocation is the way to go.

Rental rates in Hamilton have remained the same since last year, with the average 2-bedroom apartment renting for $1438. Detached, 3-bedroom houses listed on MLS range from about $1800-2800/month, depending on area, size, and amenities.

If, after figuring out your net proceeds from the sale of your property, you feel that you have enough to feel comfortable renting at these prices – that may be the direction you choose to go!

-

What stage of life are you at?

There is a difference between hedging your bets in your 20’s and 30’s and reducing your exposure as you approach retirement.

Older home owners whose mortgage is paid off and who are depending on the equity in their home for their retirement fund may choose to cash out now.

We strongly recommend that you discuss your plans with a qualified financial advisor. They can offer suggestions for the best way for you to invest the proceeds from a house sale. Be sure that the equity you have now is enough to provide the standard of living that you desire. If you’ve done the research and you feel comfortable taking your profits – now might be a good time.

Some younger home owners speculate that the market will drop. Their plan is to sell now and buy low later on.

If you are considering this, you might want to think a little longer about your decision. That plan could very well be a money-maker – and your speculation could turn out to be spot-on. However, it’s important that you consider all the implications.

Are you at risk of losing your job? This is a practical question that does not, alone, determine whether selling your home is the right decision. For some, job loss would mean an inability to keep up with mortgage payments. If this is your situation, selling might relieve stress and give you more room to weather a financial storm. Remember, though, if you use the money from the sale to cover living expenses, you’ll have to save up a new down payment from scratch when you’re ready to re-enter the market.

On the other hand, if you have income from a side-hustle or small business that could cover your living costs, it might be wise to hold on to your property. Mortgage lenders look less favourably on the self-employed. You might find it hard to get the best rates if you sell and try to buy again in a year or two with only your small-business income.

If the fears of a falling market do materialize, a period of recovery will follow, as it always has in the past. Interest rates will eventually rise, making mortgage money more expensive to borrow. Be sure to factor in the cost of borrowing later on!

History shows that, despite dips in the market, real estate values trend steadily upward over the long-term. The question really is this: Is your house primarily your home, or do you see it strictly as an investment? Since you will always need a place to live, there will always be some expenses attached to keeping a roof over your head. Does the cost of renting save you enough to warrant selling an asset that is likely to continue to increase in value? If so, then cashing out may be a good decision.

Selling your home, your largest investment, is a huge decision at any time.

When considering a major life change, get as much information as you can – and take time to consider all your options. We would be happy to help you research values in your neighbourhood and to point you in the direction of other professionals who can help you decide whether now is your time to sell!

Wondering if You Should Cash Out?

Let us help you make the best decision!